What Is A Reasonable Amount Of Money To Retire With?

How much do you actually need to salvage for retirement?

Retirement experts have offered various rules of thumb near how much y'all demand to save: somewhere most $one meg, lxxx% to 90% of your annual pre-retirement income, 12 times your pre-retirement salary. Merely what'south correct for you? And how practice you know you're on rail?

"Because there are so many variables, even the retirement researchers tin can't hold on a full dollar amount," says Ben Storey, director of Retirement Enquiry & Insights at Bank of America. "What each person needs will vary widely based on a number of factors." These factors include your current age, and the age at which y'all program to retire or could be forced to retire due to declining health, the loss of a task, or other circumstances beyond your control; how long you lot expect to live, based on family history; how much you programme to spend in retirement; and what your sources of retirement income will be.

You may exist surprised how much — or how lilliputian — even generously-sized accounts could potentially provide over the grade of a retirement. The examples below illustrate how much a 65-twelvemonth-old might safely withdraw in the outset year of retirement.

| Savings value at age 65 | Almanac income from savings* | |

| $300,000 | | $12,060/twelvemonth |

| $1,000,000 | | $40,200/year |

| $1,500,000 | | $60,300/yr |

* The accumulated investment savings past age 65 could provide an almanac retirement income, adjusted for futurity inflation (in today'due south dollars), of this amount for a life expectancy of 91 years, if withdrawn at a sustained spending rate of 4.02%.

Source: Depository financial institution of America's Chief Investment Office, Portfolio Analytics, "Across the 4% dominion: Determining sustainable retiree spending rates," January 2021.

Just how big your nest egg should be and how long it might last will depend not only on what you save and invest, just as well on how you spend it one time you practise retire. Here are some of the factors to consider as you decide what your unique savings goal should exist.

Base your retirement savings gauge on what yous expect to spend

"Having a percent or dollar amount to requite you a rough thought for planning can be helpful, but you tin't be focused solely on that," Storey says. "Everybody'southward lifestyle is unlike. What they want to do in their retirement years may be very unlike besides." Rather than rely on a general figure, he suggests trying to create a ballpark annual guess based on what you live on now and what might change when yous retire.

The post-obit chart, based on data from the Employee Do good Enquiry Institute (EBRI),Footnote one can give you a crude idea of how your expenses for housing,Footnote ii food, wellness, transportation, clothing and entertainment may change during retirement to aid you decide how much income y'all might need. If you plan to travel or entertain more — or pursue an expensive hobby — you'll want to think near adding in something for those more flexible, discretionary expenses, also. And keep in mind that you need to consider the potential touch on of taxes on the retirement income when determining how much you volition need.

Here's how older Americans today spend their money.

| Ages 50-64 | Ages 65-74 | Ages 75 and older | |

| Housing | 45.9% | 44.9% | 45.6% |

| Food | 11.0% | 11.2% | 11.two% |

| Health | 7.8% | 9.half-dozen% | 10.half-dozen% |

| Clothing | 2.nine% | 2.9% | 2.7% |

| Transportation | 13.nine% | 12.0% | ix.7% |

| Amusement | x.ii% | 10.5% | 8.three% |

| Other | iv.7% | v.4% | 6.three% |

Source: Zahra Ebrahimi, "How Do Retirees' Spending Patterns Modify Over Time?" EBRI Issue Brief, no. 492 (Employee Do good Research Institute, October 3, 2019).

Recall, although some costs — such equally health care — may increase in retirement, at that place may exist savings elsewhere. "Researchers have found that once people retire they spend more time shopping advisedly and preparing meals at home, for example. Their cost of living for items such as these goes down," Storey says.

Go on in mind all of the income sources that tin assistance comprehend your expenses

Every bit you explore how much coin you might actually need in retirement, retrieve that the amount you decide to save and invest on your own is only one component of your future retirement income.

Most Americans will have Social Security equally the backbone of their retirement savings. (Fifty-fifty if benefit payments are reduced in the future, Social Security is not likely to go away.) And don't forget about other sources of income that may be available to you many years from now, including the money in your workplace and personal retirement accounts, pensions, annuities, proceeds from selling your abode or business organisation, rental income or an inheritance.

Working in retirement: expectations vs. reality

If you lot're planning to work in retirement so you lot can salve less today, be realistic near your expectations. The annual Retirement Confidence Survey from the Employee Benefit Research Institute (EBRI)* has consistently found that American workers are far more likely to await to work in retirement than actually terminate up doing so.

In EBRI's latest report, 72% of workers planned to work in retirement, compared with but 30% of retirees who say they actually do piece of work for pay today."

* Employee Do good Research Institute, The 2021 Retirement Confidence Survey Summary Report, April 2021.

2 ways to cheque on your progress right now

Understanding your mail-retirement expenses and income tin help yous guess how much you may need to depict from your personal savings each yr in retirement. However, it tin can be tough to turn that goal into a realistic corporeality to invest today when your goal is decades abroad. Here are two ways yous can check on your progress to see if any changes should be made.

- For a quick bank check of how you're doing today vs. similar savers:

But every bit information technology can be helpful to see how your heart charge per unit, blood pressure or weight compare with the "norm" when you go your annual concrete, at present you can assess how your retirement savings stack upwardly against your peers past using the Net Wealth to Income Ratio adult by Merrill.

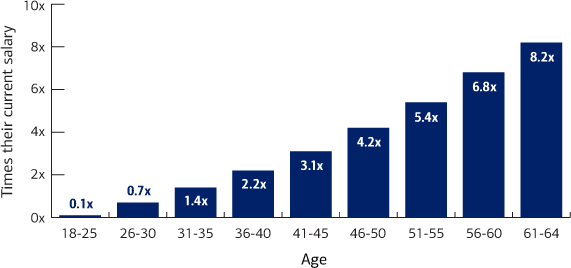

With findings based on Bank of America's Financial Health Tracker — a proprietary assessment that calculates a fiscal wellness score based on where an employee is today (password required) — consider using the post-obit savings multiples every bit guidance for replacing your income in retirement:

Source: Banking company of America, "Fiscal Wellness: 2020 Retirement savings guidance," 2020. Note: Calculations are based on obtaining 38% of income replacement from retirement savings (pre-tax) for eye income households of $40,000 to $100,000 annually.

For instance, if 35-year-one-time Jane, who earns $70,000 a year, wants to encounter how her savings measure up to the best savers in her age group, she would just multiply her current salary by 1.4 and compare that with her current savings. Thus, to go along upwardly with the "all-time savers and investors" in her peer salary grouping, she would need to have saved $98,000 ($70,000 10 1.iv) and then far.Footnote iii

- To see where you are and what you can change to stay on track for the hereafter:

The Merrill Personal Retirement Calculator lets you lot view a project of your savings to run into if there is a gap betwixt what you'll have and what you'll demand when y'all finally retire and helps you adjust your strategy appropriately.

With the calculator, yous can see how potential adjustments to your savings goal, retirement date and investment choices tin touch the size of your retirement savings in the futurity.

But even if this checkpoint shows that you're behind where you might be, don't become discouraged past the large numbers y'all may see, advises Storey.

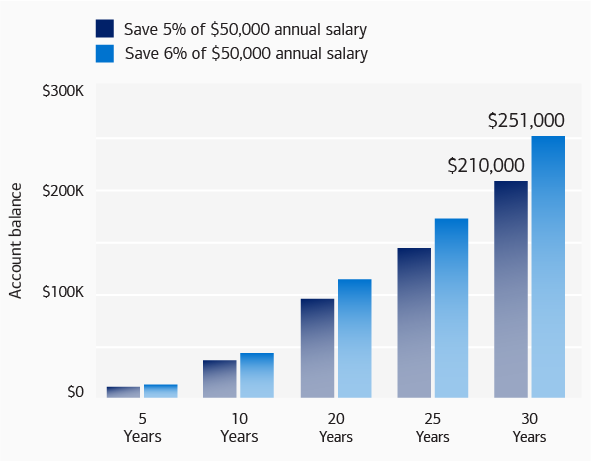

A small change in savings could give y'all essentially more than later thirty years.

Source: Bank of America, April 2021. This example is hypothetical and does not represent the performance of a item investment. This example assumes annual returns internet of fees and expenses. Your results will vary. Actual investing includes fees and other expenses that may consequence in lower returns than this hypothetical example.

Whatever you salvage and invest today for the long term can make a large difference in the future. "If yous need to salve more, even a i% increase can mean a lot over time," he says.

Footnote 1 Based on estimates from the Health and Retirement study (HRS) and the Consumption Activities and Mail Survey (CAMS) in EBRI notes.

Footnote 2 Note: Housing costs include mortgage or rent payments, property insurance, property taxes, utilities and maintenance. They typically go down in retirement because mortgages are paid off, property taxes are less due to downsizing, and utility bills are lower with fewer people in the household.

Footnote iii This number refers to financial assets minus personal (non-mortgage) debt. "All-time savers and investors" refers to those whose Internet Wealth to Income Ratio is in the pinnacle quintile.

Investing involves risk. There is e'er the potential of losing money when you invest in securities.

This material should exist regarded as (general or educational) information on Social Security considerations and is not intended to provide specific Social Security advice. If you accept questions regarding your detail situation, delight contact your legal or tax counselor.

MAP4458859-03222023

Source: https://www.merrilledge.com/article/how-much-do-you-really-need-to-save-for-retirement

Posted by: batchelorcomitaxby1995.blogspot.com

0 Response to "What Is A Reasonable Amount Of Money To Retire With?"

Post a Comment